1. Introduction

Choosing the perfect term life insurance policy can be a maze to be in. With so many providers, term length, coverage amounts, and premium rates, you can easily become bewildered. However, making the right policy choice is essential to ensure that your loved ones are in a decent financial state in case of the worst happening. This informative, SEO-saturated guide will guide you through 10 most important steps in comparing term life insurance policies and choosing the best for your future.

We’ll take you through it step by step, so you’ll not only know what to look for in a policy, but you’ll also know how to shop around for providers, how to gauge your true insurance needs, and feel secure making a decision that will protect your loved ones for years to come.

“Life insurance is not for you—it’s for those you leave behind.” — Suze Orman

2. Step 1: What Is Term Life Insurance?

Term life insurance is a type of life insurance that covers the policyholder for a chosen time frame (or “term”), e.g., 10, 20, or 30 years. If the policyholder dies during the term, the insurance company pays a death benefit to the beneficiaries. Term policies do not build up cash value like whole life insurance policies.

This type of insurance is typically not as costly as permanent life insurance, so it is ideal for individuals who only need coverage for a specific duration—like until the mortgage can be paid or until children reach adulthood.

Term Life Insurance advantages:

- Lower premium costs upfront

- Simple, plain-vanilla coverage

- Length and amount of coverage can be adjusted

Image source: Freepik

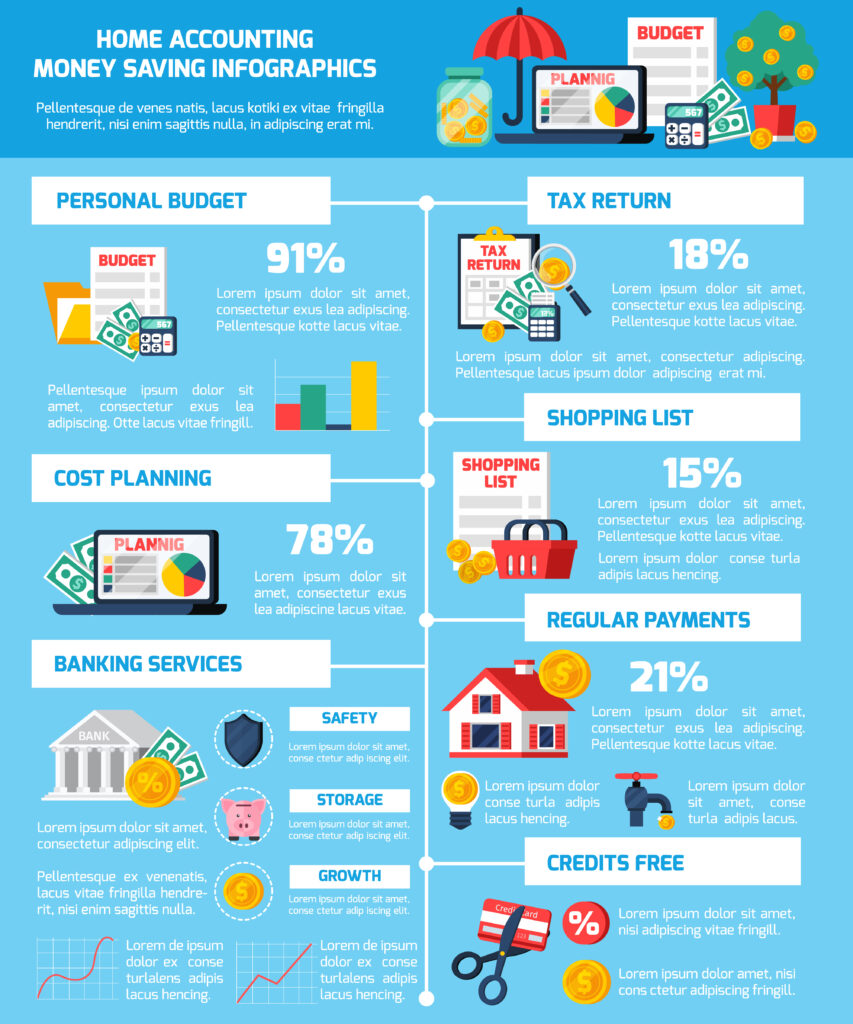

3. Step 2: Evaluate Your Financial Needs

Before you choose a policy, determine how much money your family would need if you weren’t around. Factor in debts (mortgage, car loans, credit cards), future expenses (college, retirement), and ongoing living expenses.

Take into account inflation and living costs over time. You can also take into account ultimate costs such as funeral costs, medical costs, and estate taxes. Thorough analysis will avoid you from being underinsured.

List of Expenses to Include:

- Outstanding debt

- Children’s education

- Daily living costs

- Ultimate costs

- Emergency fund

Image source: Freepik

“Start with the end in mind. What do you want the insurance to do for your family?” — Clark Howard, financial advisor

4. Step 3: Choose the Appropriate Term Duration

The duration of the term should also be proportional with your financial responsibilities. For example, a 20-year term can be appropriate if you have children, while a 30-year term can service a mortgage.

Common term durations are:

- 10 years: Ideal for short-term needs or financial transition periods

- 20 years: Common for young families and new homeowners

- 30 years: Long-term protection, especially if you’re in your 30s or younger

- Evaluate your age, financial goals, and how long your dependents will rely on your income.

5. Step 4: Determine the Coverage Amount

Experts typically recommend 10 to 15 times income in coverage, but your individual situation may call for more or less. If you have substantial debt or expect to have large kids’ educational expenses, additional coverage may be prudent.

How to Calculate Coverage:

- Take income and multiply it by the number of years’ support your household would need

- Add estimated one-time costs (education, final expenses)

- Subtract current savings and other present life insurance policies

6. Step 5: Compare Different Insurance Providers

Get quotes from multiple companies and compare their plans side-by-side. Look at the following factors to compare: premium rates, customer service, flexibility of policy, and online resources or app availability.

Check if the provider has:

- Easy online applications

- No-medical exam policies

- Bundled discounts with other types of insurance

- Strong customer service and mobile access

Expert Quote: “Don’t just go with the cheapest option. Look for reliability and service quality.” — Dave Ramsey

7. Step 6: Consider Policy Riders and Add-Ons

Riders are added benefits that can augment your policy. They provide more flexibility and customization.

Common Riders:

- Waiver of Premium: Waives premiums if you become disabled

- Accidental Death Benefit: Additional payment if accidental death occurs

- Child Term Rider: Insures your children

- Critical Illness Rider: Pays cash if diagnosed with a severe illness

- Riders can really add value to your policy—especially if you have health risk or special-needs dependents.

8. Step 7: Review Premiums and Payment Plans

Premiums are level (fixed) or variable. Level premiums stay the same throughout the term, whereas variable premiums may increase as you age.

Questions to Ask:

- Are the premiums guaranteed to be level?

- Is there a grace period for late payment?

- Are payments made annually discounted relative to payments made monthly?

Expert Quoting: “A term policy should be affordable enough to retain comfortably for the term.” — Barbara Weltman, small business and finance author

9. Step 8: Check Insurers’ Financial Strength and Reputation

Choose insurers with strong financial ratings from bodies like A.M. Best, Moody’s, or Standard & Poor’s. This places your insurer in a position to deliver on its promise decades down the line.

Also, check:

- Claim settlement ratios

- Customer satisfaction reviews

- Company longevity and market share

10. Step 9: Read the Fine Print

Policy exclusions, limitations, and renewal terms are crucial to understand before signing. Some policies may not cover suicide within the first two years or deaths resulting from risky behavior.

Be cautious of:

- Lapsed policies due to non-payment

- Exclusions for pre-existing conditions

- Renewability and conversion options

11. Step 10: Obtain Expert Guidance

Consult with a qualified insurance consultant or financial advisor who is familiar with the inner workings of many various policies and will take you through their in and outs. They’ll make complicated definitions easy to understand, hunt down sneaky fees, and obtain the policy that is exactly right for where you’re at in your life.

Discover:

- Fee-only planners with fiduciary obligation

- Certified Financial Planners (CFP)

- Independent insurance agents for more than one insurer

Final Thoughts

Picking term life insurance is one of the most important financial decisions you will ever make to protect your loved ones. Armed with the right information and counsel, you can select a policy that helps you have peace of mind and financial stability. Compare them wisely and do not hesitate to seek expert help.

As your situation in life changes—marriage, children, new career—it’s worth it to review your policy every so often. You might find that you desire additional coverage, or that you should switch to a permanent life insurance policy.

Need more info? Join our community of subscribers for free resources, expert insights, and policy comparison manuals mailed straight to your inbox.

More on Afripati